Chicago’s “property tax bonfire” didn’t just spark flames—it ignited a citywide reckoning over how much homeowners really owe, who benefits, and what comes next for neighborhoods teetering between hope and frustration.

Story Snapshot

- Lawndale residents protested skyrocketing property taxes by burning bills in a public event, demanding transparency and reform.

- Organizers and local officials clashed over opaque tax policies, gentrification, and the perceived lack of neighborhood investment.

- Calls for California-style tax caps and new payment plan options signal a pivotal moment for Chicago’s fiscal future.

- Grassroots activism is driving public debate, pressuring elected leaders to address deep-rooted inequities in city tax structures.

Symbolic Protest in Lawndale Shines Spotlight on Tax Grievances

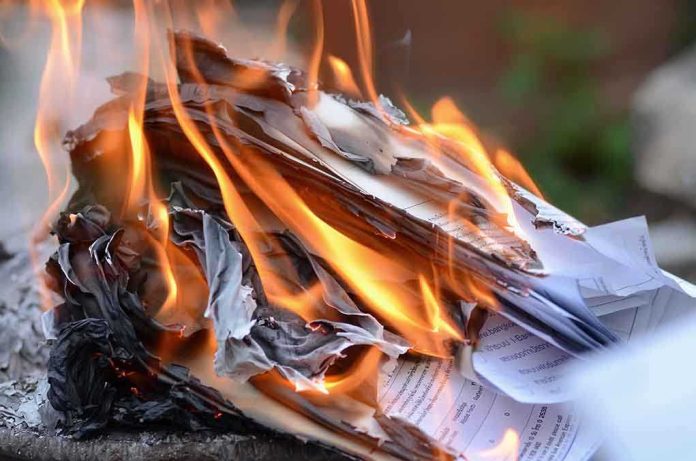

Harmony Community Church pulsed with anticipation on November 15, 2025, as Lawndale homeowners gathered for a “property tax bonfire” protest. The event, organized by Dr. Richard Townsell and the Lawndale Christian Development Corporation, invited residents to toss their latest tax bills onto the flames. The act was powerfully reminiscent of the Boston Tea Party, signaling collective outrage not just at rising costs but at the system’s lack of transparency and fairness. Community members shared personal stories of bills ballooning by hundreds—sometimes nearly $1,000—over the previous year, with no visible improvements in schools, safety, or infrastructure. The protest’s open forum format allowed frustration to transform into calls for action, with many demanding policy change modeled after California’s Prop 13, which caps annual property tax increases.

Residents expressed their sense of betrayal, asking why they pay more when their neighborhoods see little reinvestment. The bonfire’s symbolism amplified their message: enough is enough.

Historical Roots of Chicago’s Tax Discontent

Chicago’s tax system has long been tangled in complexity and controversy. The city relies on property taxes to fund schools and public services, yet working-class and minority neighborhoods shoulder a disproportionate burden. In Lawndale, decades of disinvestment have left infrastructure lagging, even as Tax Increment Financing (TIF) districts siphon revenue for redevelopment elsewhere. Homeowners now find themselves squeezed between gentrification pressures and mounting fiscal obligations. Previous protests in other neighborhoods have fizzled, but the Lawndale bonfire marks a fresh escalation—one fueled by both anger and an emerging sense of solidarity.

As tax bills climbed in early November, the disconnect between rising costs and stagnant community investment became impossible to ignore. The city’s opaque assessment practices left many residents feeling powerless, fueling calls for reform that prioritize transparency and equity.

Local Officials Confront Homeowner Demands

Key stakeholders arrived at the bonfire, including State Rep. Yolanda Morris, State Senator Lesha Collins, County Commissioner Michael Scott Jr., and Cook County Treasurer Maria Pappas. These officials faced a barrage of questions about policy, fairness, and the future of Lawndale. Dr. Townsell and other organizers emphasized that solutions must come from the community, not just politicians. Residents demanded accountability, advocating for tax caps and assessment reforms. Treasurer Pappas responded by announcing new payment plan options, allowing up to 13 months for homeowners to pay their bills. She clarified that the December 15 deadline was not absolute, offering practical relief but stopping short of promising structural change.

This direct engagement signaled both the seriousness of the issue and the potential for legislative action. The event drew significant media attention, amplifying homeowner voices and increasing pressure on leaders to deliver concrete reforms.

Ripple Effects: Economic, Social, and Political Stakes

The bonfire’s impact extends beyond Lawndale. In the short term, public awareness has soared, prompting local officials to reconsider payment flexibility and assessment practices. In the long term, the movement could reshape Chicago’s property tax policy, with possible adoption of tax caps and renewed investment in neglected neighborhoods. The economic strain on homeowners threatens to accelerate displacement, destabilize communities, and disrupt the local real estate market.

Chicago homeowners demand answers, speak out at 'property tax bonfire' https://t.co/qNScfMpsP7 #FoxNews

— Rob Beto Aragon🇺🇸🇮🇱🇻🇦 (@gopwillrise) November 17, 2025

Socially, the event has galvanized grassroots activism, fostering neighborhood cohesion even as it exposes fault lines between residents and city leadership. Politically, the bonfire has triggered greater scrutiny of TIF districts and opened debate on the future of municipal finance. The intersection of gentrification, fiscal policy, and community empowerment sits at the heart of these developments, pushing Chicago toward a critical juncture in its civic life.

Expert Perspectives: Reform or Retreat?

Community leaders frame the protest as a turning point, likening it to historic acts of defiance against fiscal injustice. Policy experts warn that tax caps, while offering relief to homeowners, risk undermining funding for vital public services. Urban scholars highlight the need for transparent assessment and equitable investment, noting that unchecked tax hikes can drive displacement and erode neighborhood stability. Elected officials remain divided, with some arguing for higher taxes to support public goods, while residents counter that they see little return on their investment.

This debate will shape Chicago’s future, as the city weighs the costs and benefits of reform. The bonfire protest has forced a public reckoning, opening a window for systemic change—if leaders and residents can find common ground.

Sources:

Chicago homeowners speak out on new property tax increases at bonfire on West Side